Cost Per Contact

Learn how to calculate and reduce cost per contact in call centers with LiveAgent's solutions. Optimize customer interaction costs today!

ROI is a key metric for assessing investment profitability and efficiency, but has limitations like ignoring time and risk. It aids in financial decisions and is crucial for good customer service, enhancing brand loyalty and revenue.

Return on investment (ROI) is a popular metric that evaluates an investment's profitability and efficiency. The metric is integral when comparing the profitability of multiple investments.

A return on investment metric gives the foresight to determine whether an investment will deliver a positive return. It, therefore, lets you make financial decisions that are more likely to be successful.

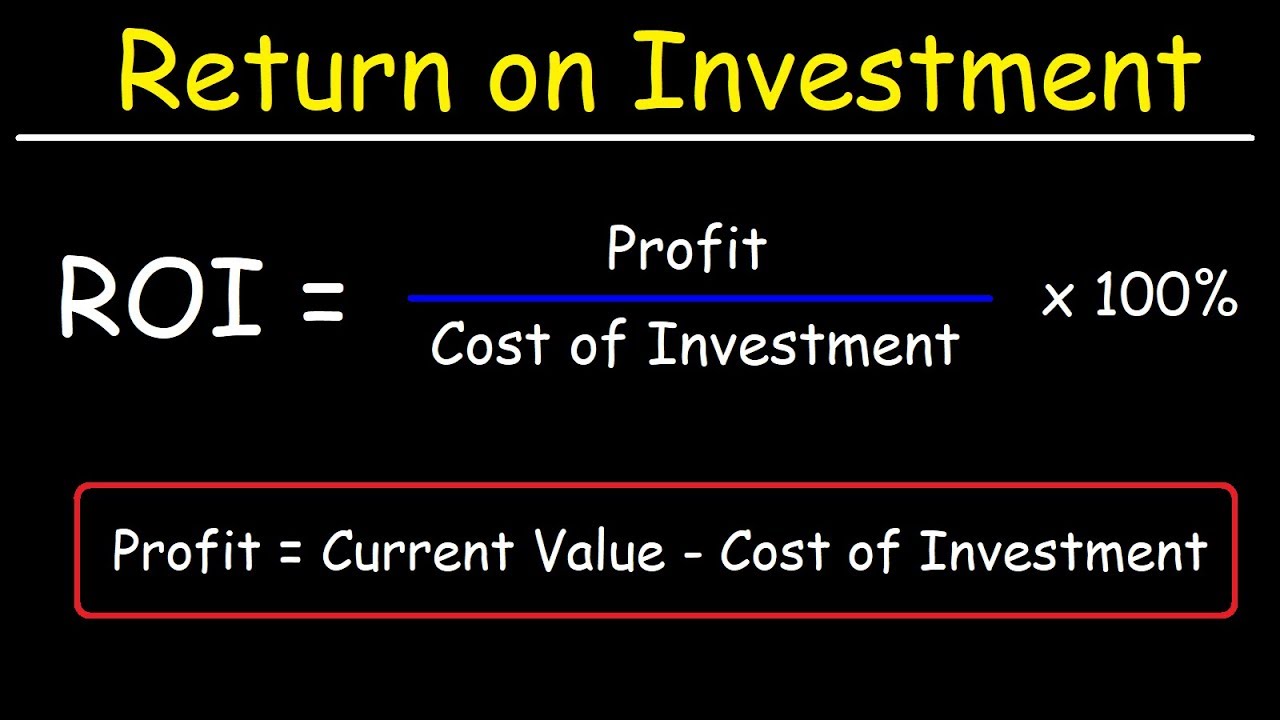

Basic ROI calculation entails:

Formula:

ROI = (Final investment value – Initial investment value) / Cost of investment × 100%

Or alternatively:

ROI = Net return / Cost of investment × 100%

The problem with the average ROI formula is that it doesn’t take into account time periods.

For instance, consider a business that sets up an ROI call center solution with LiveAgent’s software and makes a return on investment of 20% in 3 years. The formula suggests that returns after 10 days of the setup and returns after 3 years are the same. In reality, a return of 20% in 10 days is much better than 3 years.

To overcome such a problem, you can use the annualized ROI formula to get an annual return.

The formula for calculating annualized returns is as follows:

Annualized ROI = [(1 + ROI)^(1/n) – 1] × 100

Let’s assume an investment has generated a return on investment ratio of 60% over six years. A beginner investor can assume that the simple average ROI is 10% by dividing returns by the holding period.

But this is only a rough approximation of annual return because it ignores the effect of compounding on investment (which can make a significant difference over time). The longer the period, the bigger the difference.

The annual rate in this case, from the correct formula, is:

Annual ROI = [(1 + 0.60)^(1/6) – 1] × 100 = 8.15%

You can use it for holding periods less than a year by converting the holding period to a fraction of a year.

A positive return on investment means a net profit because the returns exceed the conversion cost and any additional costs that might occur.

A negative ROI shows a loss in the value of the investment during a specific period. It refers to a loss, either on investment, a business performance, or an invested project.

You can use ROI’s formula to:

Although a return on investment is easy to calculate, it’s not without limitations:

The return on investment formula ignores the time value of money and is less accurate when evaluating long-term investments. It doesn’t consider the broader time value of money or an investment’s holding period. This means it can be less accurate when assessing long-term investments that require more time to turn a profit.

Risk and return are always intertwined. The higher an investment’s potential return, the greater the corresponding risk. ROI’s projections don’t evaluate associated investment risks, only the final and initial cost.

The formula only compares the cost of investment to the final cost. Every firm you compare must follow similar accounting practices to maintain consistency. If you assess a company’s asset value or profit differently, it might make the direct return on investment comparison inaccurate.

To overcome the above limitations, investors consider the annualized return on investment to assess the profitability of an investment.

Calculating returns alone can be a trap. It measures efficiency, which is fine and useful.

If a company cuts its budget in order to reduce investment and maintenance costs, it might end up with false calculations.

While maintaining a low maintenance cost is critical, cutting on marketing campaigns or any other marketing investment might cripple the rate of earnings.

A business might still have positive ROI calculations in such a case, but not realize its full earning rate potential because of focusing on short-term results.

What’s considered a good ROI depends on the type of investment. For instance:

| Type of investment | Example of Good ROI |

|---|---|

| A marketing campaign | Multiplying your investment 5X |

| Social media marketing effort | Growth of followers count or post impressions |

| Investing in customer relationship management | 140% increased expenditure on product |

| Venture capitalism | Extra-high potential returns because only 4/10 startups make a profit |

| Setting up ROI call center solutions | Increased customer retention rate and lifetime value |

Not all investments are equal—look at risk-adjusted returns as the performance measure.

According to conventional wisdom, an annual ROI of over 7% is good for stock investment. This is the average annual return of the S&P 500, accounting for inflation.

However, the S&P ROI figure might be unfit for your asset class or the risk level you’re willing to take. It varies with different investments, so you might want to consider:

Generally, the higher the return, the better. However, it’s difficult to find a business with increased investment returns without higher risk in real life.

Risk is integral in assessing rate or return. A high potential return comes with a bigger risk.

Probing the market and taking advantage of investing research services can keep you well-informed with important factors that need to be considered when making decisions, such as risk assessment, market analyses, and financial recommendations.

Generally, a good ROI is positive—the net returns exceed net costs. A bad ROI is negative—the net cost exceeds the returns.

LiveAgent help desk software helps companies manage customer inquiries and digital conversations. This powerful tool enables companies to automate routine customer tasks, prioritize customer inquiries effectively, and measure return on investment (ROI). Built-in analytics enable companies to gauge customer sentiment, quickly identify growth opportunities, and increase customer satisfaction. LiveAgent HelpDesk software also provides an intuitive user interface for customer service agents in order to maximize product adoption and customer satisfaction. With all these features, LiveAgent HelpDesk software provides companies with an unparalleled return on investment through increased customer satisfaction, higher revenue growth, and better customer service.

Boost your return on investment through improved agent efficiency and customer retention. LiveAgent's help desk software delivers measurable results.

Return on investment (ROI) is a simple ratio that divides the net profit (or loss) from an investment by its cost.

To calculate return on investment, divide net profit (present value – initial investment) by the cost of investment and multiply that by 100.

The return on investment formula does not take time into account. It thus ignores compounding returns. The formula doesn't adjust for risks either, so that is something else to be taken into consideration when making investment decisions.

It depends on the situation. There is no one-size-fits-all definition that would apply to all instances. However, it can be agreed that the higher the ROI, the better.

Learn how to calculate and reduce cost per contact in call centers with LiveAgent's solutions. Optimize customer interaction costs today!

First Call Resolution (FCR) is a key customer service metric that measures a company's ability to resolve issues on the first interaction, enhancing customer sa...

Boost customer satisfaction with expert tips on call resolution. Learn how to measure, improve, and tackle challenges effectively!